Stock market news live updates: Stock futures hold steady after S&P 500 loses steam in mixed trading session – Yahoo Finance

U.S. stock futures were muted on Tuesday after the S&P 500 took a breather in earlier trading, closing out a choppy session day in the red after the index ceased a four-day climb toward its 70th all-time high. Contracts on the Dow, S&P and Nasdaq ticked up slightly but were mostly flat. Markets closed on […]

Deriving High Yields From Decentralized Derivative Markets – Coindesk

When compared to other decentralized derivative systems such as Perpetual Protocol and DYDX, Qilin stands out for its innovations, while staying true to the ethos of decentralization. Its liquidity design is peer-to-pool, rather than a virtual automated market maker (vAMM) or even a centralized order book, while the liquidity providers are token holders not approved […]

Aniline Derivatives Market Estimated to Experience a Hike in Growth by 2021-2031 – Digital Journal

Aniline Derivatives Market: Introduction Transparency Market Research delivers key insights on the global aniline derivatives market. In terms of revenue, the global aniline derivatives market is estimated to expand at a CAGR of ~6% during the forecast period, owing to numerous factors, regarding which TMR offers thorough insights and forecast in its report on the global aniline derivatives […]

Stock market news live updates: Futures tick higher after S&P 500 hits fresh record to kick off Santa Claus Rally – Yahoo Finance

U.S. stock futures were up Tuesday morning after the S&P 500 closed at another record high in an all-around strong day for markets that jump-started the anticipated year-end bull run known to investors as the Santa Claus Rally. Contracts on the S&P 500, Dow, and Nasdaq were up modestly ahead of the day’s trading session. […]

Huobi launches USDT-margined futures as firm looks to lead derivatives trading – FinanceFeeds

In 2020, Huobi Futures generated $2.3 trillion in 2020 trading volumes. High-volume VIP traders and institutional clients were detrimental to such trading volumes. Huobi Global has launched a new derivatives product, USDT-margined futures, which uses USDT as the margin and to calculate profit. The product complements the existing suite of derivative instruments, including USDT-margined swaps, […]

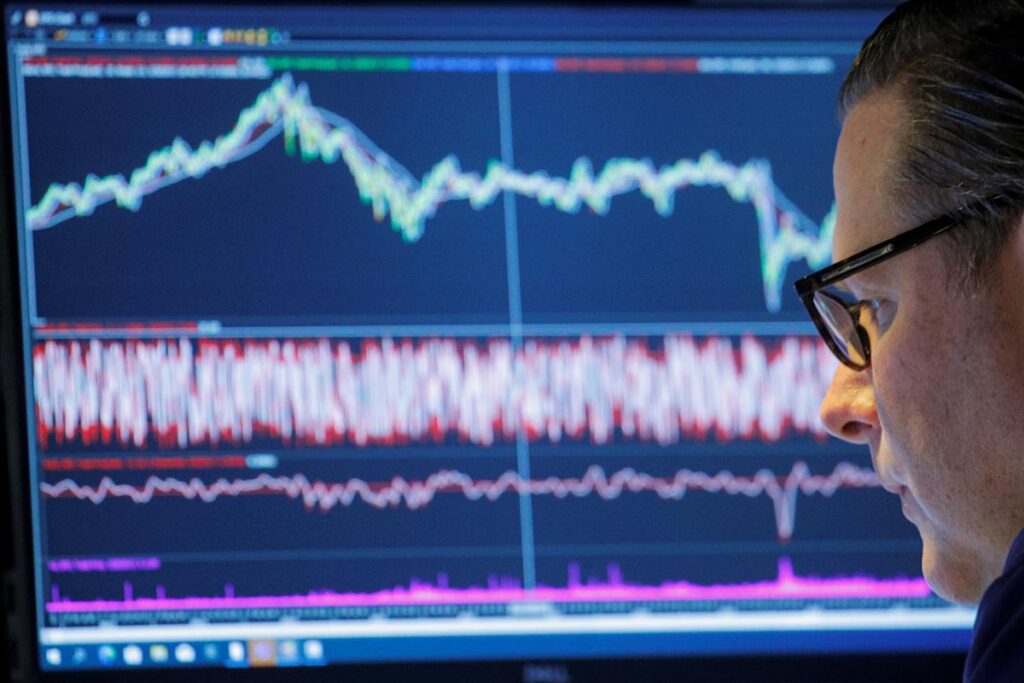

Traders turn to derivatives that protect against US market fall – Financial Times

Investors are increasingly turning to a tool to protect them if the US stock market careens lower in the coming weeks. Traders are buying put option contracts in ever greater numbers, hoping the derivatives will provide a hedge if stocks fall from record territory. The rising use of put contracts, including by the swell of […]

Huobi Global Launches USDT-Margined Futures, Expanding Suite of Crypto Derivatives Products – PR Newswire India

LONDON, Dec. 27, 2021 /PRNewswire/ — Huobi Global, one of the world’s leading digital asset exchanges, today announced the launch of USDT-margined futures, a derivatives product that uses USDT as the margin and to calculate profit. This launch comes as Huobi Futures, a digital asset derivatives trading platform under Huobi Group, celebrates its third founding […]

Huobi Global Launches USDT-Margined Futures, Expanding Suite of Crypto Derivatives Products – PR Newswire UK

LONDON, Dec. 27, 2021 /PRNewswire/ — Huobi Global, one of the world’s leading digital asset exchanges, today announced the launch of USDT-margined futures, a derivatives product that uses USDT as the margin and to calculate profit. This launch comes as Huobi Futures, a digital asset derivatives trading platform under Huobi Group, celebrates its third founding […]