The only financial certification focused exclusively on the derivatives markets

The Certified Futures and Options Analyst (CFOA) is the flagship certification of the International Council for Derivative Trading (ICFDT). It was created to establish a clear and credible standard for expertise in financial derivatives, focusing on the areas of options, futures, and related risk management techniques.

Derivatives play an essential role in global finance, forming the backbone of risk transfer, price discovery, and speculative strategies used by leading hedge funds, proprietary trading firms, and institutional asset managers. In 2023 alone, more than 137 billion futures and options contracts were traded globally, reflecting both the scale and the growing importance of these instruments in modern markets. Despite this prominence, few professional credentials address derivatives in depth, leaving a gap for practitioners whose work depends on these products.

The CFOA fills that gap. It equips candidates with a comprehensive understanding of how derivatives function, how they are priced, and how they are deployed across strategies ranging from hedging to complex multi‑legged trading structures. Successful candidates demonstrate not only theoretical knowledge but also practical readiness for roles where derivatives are central to investment and risk decisions.

By maintaining rigorous standards and an exam aligned with current market practices, the ICFDT ensures that the CFOA remains relevant to both employers and professionals worldwide. The designation serves as a trusted benchmark for those seeking to validate their skills in one of finance’s most technical and dynamic domains.

Candidates must pass the CFOA® exam and have at least one of the following:

• A university degree in Finance, Business or a related field.

• At least 2 years of proven experience in options and/or futures trading, either as a professional or as an independent investor.

• A certificate of completion from an ICFDT authorized course provider.

UPDATE: In response to industry participants asking for a way to also certify talent from different backgrounds, as of September 2024, the ICFDT has removed the above requirements for certification. This means that candidates who may not necessarily have a Finance background or proven +2 years of trading experience can still register for the examination and become fully CFOA certified if successful on the examination. This is intended to promote inclusivity and recognize diverse talents within the industry.

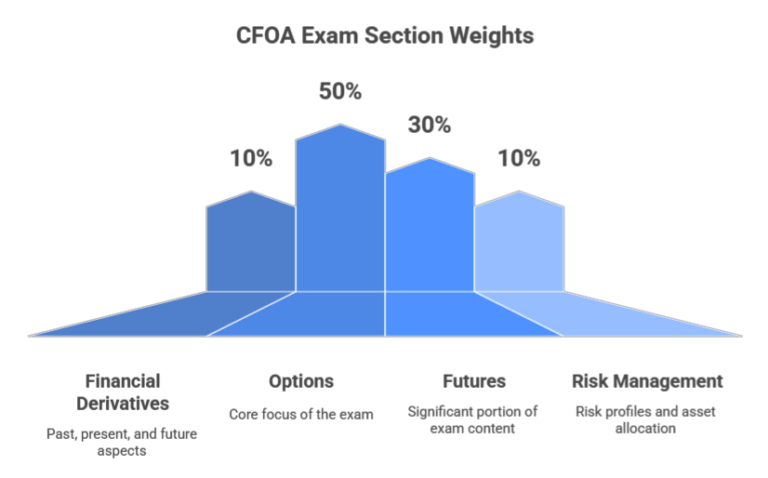

The exam is an 80-minute long multiple-choice test, made up of 100 questions, distributed in the following way:

• Section I: 10%

• Section II: 50%

• Section II: 30%

• Section IV: 10%

The exam can be taken in a test center, or remotely through an online proctoring system, anywhere in the world.

Exams are scheduled throughout the year, allowing candidates to select their preferred date and time.

Results are typically released within two weeks, with 3rd party-verifiable digital certificates issued upon passing.

The exam’s difficulty is designed to mirror the analytical rigor expected in professional trading environments. Historical pass rates range between 55% and 65%, reflecting the CFOA’s position as a selective but attainable certification for committed professionals.

I

Financial Derivatives: Past, Present, and Future

Options Contracts

Concept, Types, Chains, Pricing, Time, Volatility, Greeks, Intrinsic & Extrinsic Value

II

Options

Options Trading Strategy

Naked Strategies, Verticals, Strangles, Straddles, Multi-Legged Strategies, Breakevens

Options Trade Management

Probabilities, Standard Deviations, Entering and Exiting, Risk Management

Futures Contracts

Concept, Types, Markets, Cost to Carry, Contango & Backwardation, Basis

III

Futures

Futures Trading

Directional, Intermarket Spreads, Calendar Spreads, Limit Moves

Options on Futures

Concept, Settlement, Hedging, Speculation

IV

Risk Profiles, Asset Allocation & Risk Management

Access to the complete, detailed curriculum for the Certified Futures & Options Analyst (CFOA) qualification.

Candidates preparing for the CFOA® examination may choose between two official preparation pathways: studying with an authorized course provider or preparing independently using the ICFDT’s official materials. Both routes are fully supported.

Candidates seeking a structured, guided learning experience may prepare through an ICFDT-authorized course provider. The current primary provider is:

TrendUp Finance (Authorized Program Partner)

TrendUp offers a comprehensive, exam-aligned curriculum with instruction, practice exercises, strategy walkthroughs, and exam preparation support.

Candidates enrolled through an authorized provider will have their CFOA® exam registration managed directly by the provider, and do not need to use the self-registration form on this page.

Candidates who prefer independent study may prepare using the official ICFDT resources. These materials reflect the precise structure and depth of the CFOA® exam and may be purchased during registration below.

• Full CFOA Textbook — $149

The complete reference covering all curriculum sections, from derivatives fundamentals to options, futures, volatility, pricing models, and risk management.

• Study Guide — $99

A structured, chapter-aligned summary designed for efficient review and reinforced understanding.

• Question Bank — $49

A collection of exam-style multiple-choice questions with explanations, mirroring the difficulty and format of the real CFOA exam.

As described below, self-study candidates can add these materials during the exam registration process. If you wish to purchase only the preparation materials for now, simply uncheck the exam registration box. You will still be asked to choose a target exam date for reference, but this does not register you for the exam unless selected.

The CFOA designation is internationally recognized as a mark of competence in derivatives trading, valuation, and risk management. It signals to employers that a candidate possesses both the theoretical understanding and the applied judgment needed to operate effectively in professional markets.

CFOA holders are employed across asset management firms, hedge funds, family offices, proprietary trading groups, banks, and research institutions. The certification provides strong signaling power for roles such as:

The program remains continually aligned with institutional practice and market evolution. Its curriculum reflects the frameworks and tools used by today’s trading and risk teams, from pricing and volatility analysis to portfolio hedging and exposure management.

This ongoing relevance ensures that the CFOA is not an academic exercise but a practical qualification designed for professionals who engage with real-world financial risk. It bridges the gap between conceptual understanding and strategic application, preparing candidates to perform in environments defined by uncertainty, leverage, and speed.

For employers, the CFOA serves as independent validation of a candidate’s readiness for analytical and risk-focused roles. For professionals, it represents a lasting credential that confirms both technical mastery and professional seriousness within the global derivatives industry.

Candidates may register for the CFOA® exam through one of two routes:

• Sponsored by an authorized course provider: Candidates who have successfully completed an ICFDT-authorized training program will have their CFOA® exam registration handled directly by the provider. There is no need to use the registration form on this page.

• Self-Study: Candidates who prefer to prepare independently can register directly as individual candidates by completing the form in the “Register for the CFOA” link below. Optional self-study materials such as the Official CFOA textbook, Study Guide and Question Bank may be added at checkout. If you wish to purchase only the preparation materials for now, simply uncheck the exam registration box. You will still be asked to select a target exam date for reference, but this will not affect your order since exam registration is disabled.

The current exam fee is $390. There are no additional fees or annual dues, and once you pass the exam, your CFOA status is valid for life.

Successful candidates are entitled to use the CFOA designation after their name (for example, Jane Smith, CFOA), signifying their status as Certified Futures and Options Analysts.