InvestTech Advanced Solutions Has Analyzed Contemporary Advancements in Longevity Derivatives, the corresponding Market Dynamiсs, and Main Players Interests

— InvestTech Advanced Solutions

LONDON, UNITED KINGDOM, August 17, 2021 /EINPresswire.com/ — InvestTech Advanced Solutions, a subsidiary of Deep Knowledge Group, releases an open-access, 45-page report to provide a bird’s eye view, explanation, and analysis of Longevity Derivatives, including a comparison with other financial instruments.

Link to the Analytical Report: www.invest-solutions.tech/longevity-derivatives

Link to the Interactive Dashboard: www.aginganalytics.com/finance-dashboard

The Report identifies several major trends and insights regarding the landscape of the different types of Longevity-derived financial instruments and many other important factors based on a detailed examination of the main users, overall industry dynamics, and market size. A significant part of the report is dedicated to the so-called Longevity Derivatives 1.0, the underlying asset of which is chronological age. The proprietary version, in turn, analyzes the specifics that hold the Longevity Derivatives 1.0 back and suggests ways to overcome the encountered problems.

The Report offers an in-depth analysis of the following components of the Longevity Risk Sector:

– An explanation of what is Longevity Risk, when it happens, and why entities that face it should develop effective risk management approaches.

– Leading market players: arbitrageurs, hedgers, speculators, governments, and research institutions advancing the use of the Longevity Derivatives in the Global Longevity Risk market.

– An analysis of the industry’s market structure, number, and volume of Longevity deals.

– Description and approaches to the valuation of the most popular Longevity Derivatives and the different types of financial instruments.

– Examples of the most successful and impactful Longevity Derivatives deals, emphasizing the scope of operational activities.

– Interest in Longevity Derivatives among governments.

– Comparison of biological and chronological age-based derivatives.

– The evidence of the benefits of biological age derivatives, which are described in-depth and evaluated in the proprietary part of the report.

– Hedging and investment opportunities, problems, and risks.

Some of the analysis’s key points include the following:

– A new global capital market, the Life Market, is developing, and “Longevity pools” are on their way to becoming the first major asset class of the twenty-first century. Longevity Risks arise due to inaccurate predictions of the mortality rate and numbers of retirees. Another reason why managing Longevity Risks has become more important for the entities is new regulation requirements.

– In general, these derivatives are designed to generate income for investors due to increased Longevity, as well as reduce the negative impact for companies suffering from Longevity risks. Longevity risks have a weak correlation with other financial risks; therefore, a small beta coefficient significantly attracts investors.

– Although the Longevity Derivatives Market has a large number of economic agents, the main ones are hedgers, speculators, and arbitrageurs, who are given special attention in the report. New opportunities are opening up for all these agents because of the increased accuracy of risk assessment and forecasting and selection of the correct risk management tool.

– Hedgers, such as pension funds and insurance companies, have an incentive to transfer Longevity risk off their books, especially as this risk exposure is potentially large.

– Many speculators are attracted by low correlations with traditional types of investment risks. They can bet on technological progress and thus predict future prices of derivatives based on demographic trends in population aging.

– Governments can be interested in Longevity securities to assist financial institutions which are exposed to Longevity Risk. Such actions reduce the probability that large companies are bankrupted by their pension funds, resulting in society as a whole that benefits from the greater stability of the economy. Government is also interested in managing its own exposure to Longevity Risk as it is a significant holder of this risk via the pay-as-you-go state pension system, via its obligations to provide health care for the elderly, and for many other similar reasons.

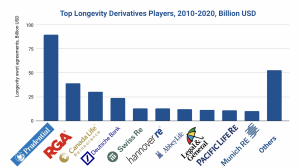

– The Longevity Risk Transfer activities mainly occur in countries with a relatively large pension market size, such as the UK, the US, Australia, the Netherlands, and France. Since 2011, Prudential Financial Inc, the leader of the Longevity swaps market, has completed approximately $90 billion in international Longevity reinsurance transactions.

– Main types of Longevity Derivatives and financial instruments are identified: different survival bonds, forwards, swaps, options, and swaptions, etc.

– The rising age of human-validated Biomarkers of Aging generates a new form of financial instrument, which we believe is better not only for Longevity Industry participants but also for traditional financial institutions because the correlation of biological age with age-related diseases is higher than the correlation of chronological age with age-related diseases. Biological age is the physiological integrity of an organism at the moment of research evaluated and based on the measurement of biomarkers. The biomarkers reveal physiological processes that change with age, diseases linked to aging, and aging itself. The implementation of Longevity Derivatives based on biological age can also reduce costs of maintaining retirement living standards due to aging and the shock of Longevity.

About InvestTech Advanced Solutions

InvestTech Advanced Solutions provides advanced investment analytics and data management tools and algorithms. Our products are sophisticated data-driven quantifiable investment recommendations generated to conduct tangible, fast, comprehensive, and inexpensive analysis and due diligence for DeepTech startups, as well as real-time financial analytics and consulting for publicly traded corporations in DeepTech sectors.

For press and media inquiries, cooperation, collaboration, and strategic partnership proposals, please contact: info@invest-solutions.tech

Ihor Kendiukhov

InvestTech Advanced Solutions

ik@invest-solutions.tech

Visit us on social media:

Facebook

Twitter

LinkedIn

![]()

You just read:

News Provided By

August 17, 2021, 10:07 GMT

Share This Article

EIN Presswire’s priority is source transparency. We do not allow opaque clients, and our editors try to be careful about weeding out false and misleading content. As a user, if you see something we have missed, please do bring it to our attention. Your help is welcome. EIN Presswire, Everyone’s Internet News Presswire™, tries to define some of the boundaries that are reasonable in today’s world. Please see our Editorial Guidelines for more information.